Move beyond the hype and learn how to integrate NotebookLM, Gemini, and Pinpoint into your reporting toolkit to find stories faster and manage your beat more effectively.

What You’ll Learn

Pinpoint: How to use this investigative powerhouse to search thousands of PDFs, handwritten notes, and audio files in seconds to identify key patterns and entities.

NotebookLM: How to create a “grounded” AI assistant using your own trusted sources to generate summaries, brainstorm story angles, and create audio briefings.

Gemini: Techniques for mastering prompts to assist with SEO headlines, social media copy, and organizing unstructured data.

Who Should Attend?

Reporters & Investigators: Anyone managing large document sets or complex beats.

Editors & Producers: Professionals looking to streamline workflows and newsroom efficiency.

Freelancers & Students: Storytellers at any stage seeking high-powered research and organization tools.

Technical Requirements

These tools are free-of-cost with a Google account.

Note: Because of its specialized investigative capabilities, Pinpoint requires users to request access. We highly recommend requesting your account here at least 24 hours before the session.

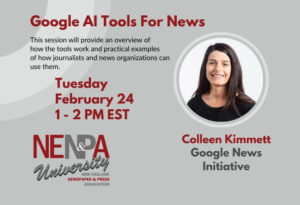

Presented by Colleen Kimmett

Colleen is a journalist and educator who worked in independent media for 15 years before joining the Google News Initiative. She started her career at The Tyee, played a founding role in The Discourse, and helped launch the Institute for Investigative Journalism at Concordia University. She’s passionate about supporting journalists and the journalism industry.

This session will not be recorded. Please plan to attend the session on the date and time.

Massachusetts has the oldest statewide probation system in the country. In November 2023, Pamerson Ifill became the first Black person appointed to lead the Massachusetts Probation Service.

Join BABJ for an important conversation about his historic role in the criminal justice system, the changes he has implemented in his first two years, and his vision for the future of probation in Massachusetts.

The discussion will be moderated by BABJ’s Melanie Morris, host of the “Yellow Jacket Lady” podcast.

Wednesday, February 25

7:00 p.m. (ET)

Zoom (link will be emailed the day before the event)

Please RSVP here to receive the Zoom link.

The GOP’s signature budget bill — OBBBA — cut taxes but also safety net programs, particularly SNAP and Medicaid. Learn to track how new work requirements affect your community with county and state-level data. Join Poynter Beat Academy for a webinar on Feb. 26 at 1 p.m. ET to get localized story ideas that explore where data makes a difference and boost your midterm coverage. Webinar offered free of charge thanks to the support of The Joyce Foundation.

Learning Outcomes

- Quantify SNAP and Medicaid impacts in your coverage area.

- Transform abstract policy into tangible effects on local communities.

- Navigate America’s Essential Data web tool to discover story ideas.

- Grasp how data sets contribute to everyday challenges in business and consumer life.

- Name withdrawn or degraded federal data sets and describe the local consequences.

- Identify data loss workarounds where they exist.

Traditional advertising may get impressions, but promotions win on engagement and truly measurable results for your advertisers. Pairing interactive promotions with branded content creates high‑value audience engagement that translates into leads, richer audience data, and repeatable revenue.

We’ll explore why advertisers are shifting budgets toward interactive experiences—sweepstakes, quizzes, native storytelling—and how you can turn these formats into recurring revenue streams. We’ll break down campaign ideas, real-world success stories, and strategies to boost advertiser ROI, deliver measurable results, and grow your advertising revenue.